Before investing in real estate, conduct a thorough assessment to identify potential issues. Set realistic emergency funds based on property age and condition, historical maintenance costs, and local market trends. Research local contractor costs and reviews to establish a realistic budget for unexpected repairs.

Planning for unexpected repairs is a crucial step in responsible real estate investment. Before purchasing a property, thoroughly assess its condition to identify potential red flags. Set aside realistic emergency funds based on historical data and local market trends. Research reliable contractors and compare costs using online reviews to ensure quality service. By strategically preparing for unforeseen repairs, you demonstrate wisdom in managing your real estate assets effectively.

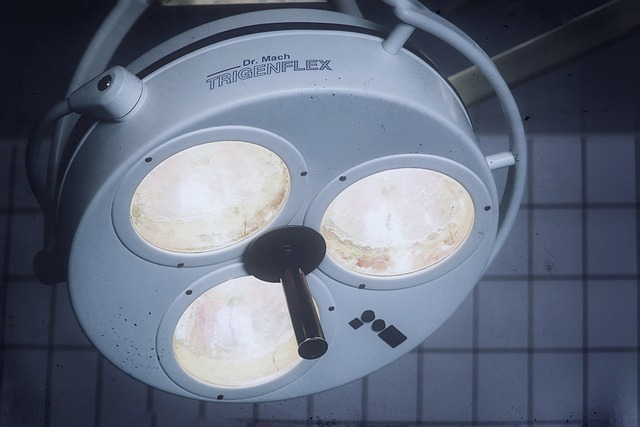

Assess Property Condition Before Purchase

Before purchasing a real estate property, it’s crucial to assess its condition thoroughly. This involves a meticulous inspection that considers structural integrity, age of fixtures and appliances, and any visible signs of damage or wear. By evaluating these factors, potential buyers can identify red flags that might indicate costly repairs in the future.

A comprehensive assessment helps in making informed decisions about budget allocation and contingency planning. It’s wise to set aside a reserve fund for unexpected repairs, as real estate properties often require maintenance beyond routine upkeep. This proactive approach ensures financial readiness for any unforeseen challenges, enhancing peace of mind during the transition to a new home or investment.

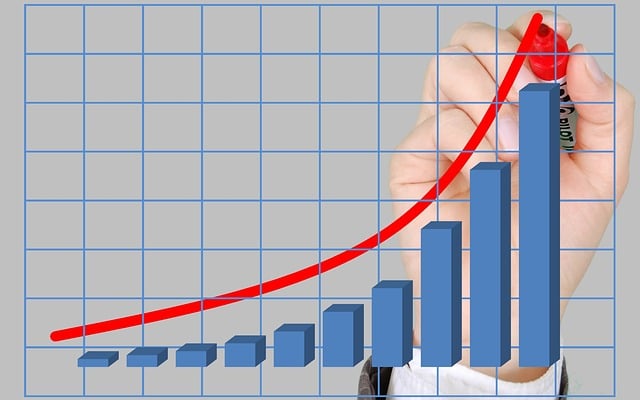

Set Realistic Emergency Funds for Repairs

When planning for unexpected repairs in your real estate investment, setting realistic emergency funds is key. It’s important to consider the age and condition of the property, as well as historical maintenance costs. For older properties, allocate a higher fund, as they tend to require more frequent and costly repairs. Regularly review and adjust these funds based on actual repair expenses and market trends in your area.

Real estate investors should aim to set aside enough money to cover at least 1-2 months’ worth of major repairs. This includes unexpected issues like roof replacements, furnace repairs, or plumbing disasters. By doing so, you’ll be better equipped to handle unforeseen circumstances without depleting your regular budget or taking on substantial debts.

Research Local Contractor Costs and Reviews

Before diving into unexpected repairs, research local contractor costs and reviews in your real estate market. This step is crucial to understanding the financial landscape of your property. Websites like Angie’s List, HomeAdvisor, and local trade associations offer valuable insights into average pricing for various types of repairs, helping you set a realistic budget.

Additionally, checking online reviews from past customers can provide important context on contractors’ reliability and work quality. This information will not only aid in choosing a trustworthy professional but also give you an idea of what fair rates look like in your area, ensuring you’re prepared for any unexpected repairs that may arise in your real estate investment.